How To Read Option Chain Pdf

-Open Interest is the number of ALL of those contracts in the world. Finding the Trend of the Market using Option Chain Most of the traders would be actively trading in options but very few make use of the NSE option chain data.

How To Read Options Chain Explained With Example

A position wherein the investor is a net writer.

How to read option chain pdf. How to Read an Options Chain. There are many components that break down an option chain such as strike prices expiration dates calls and puts extrinsic value intrinsic value bid vs ask spread the Greeks and more. Options are of two types.

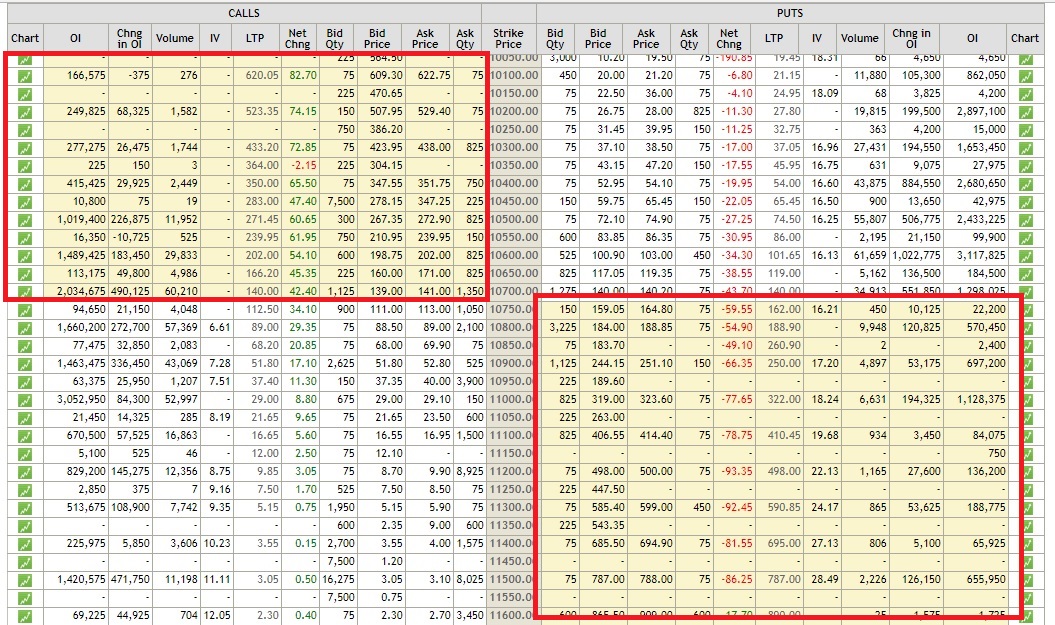

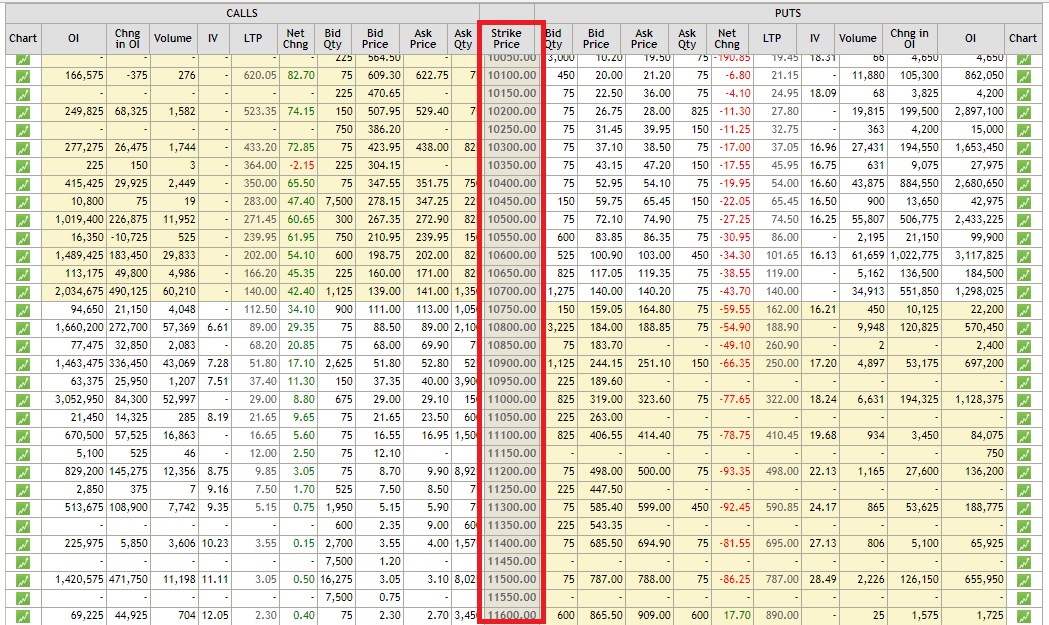

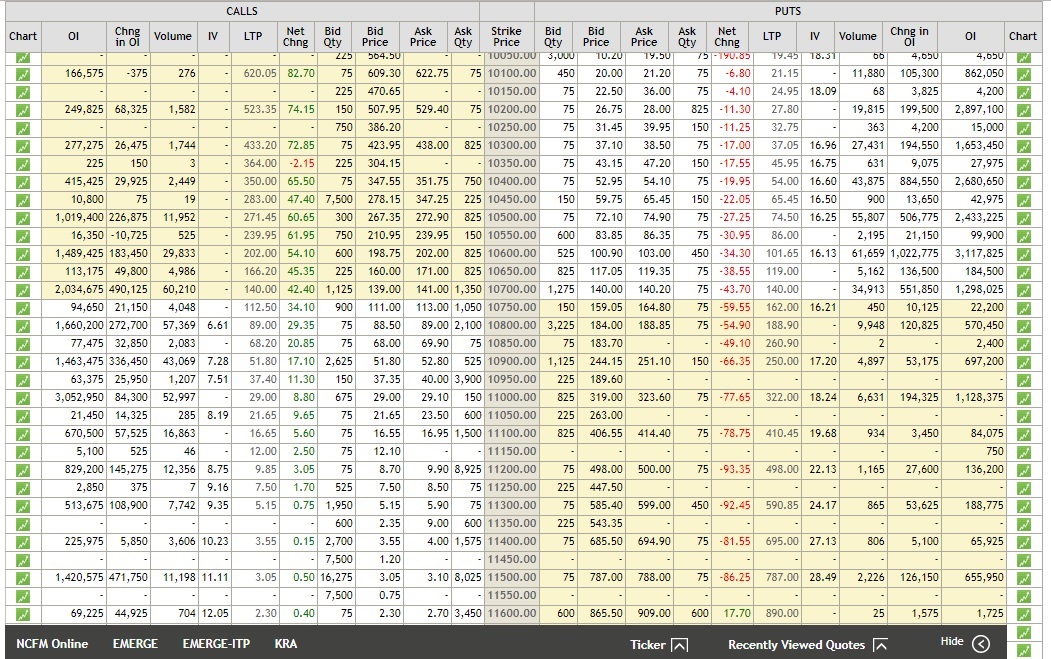

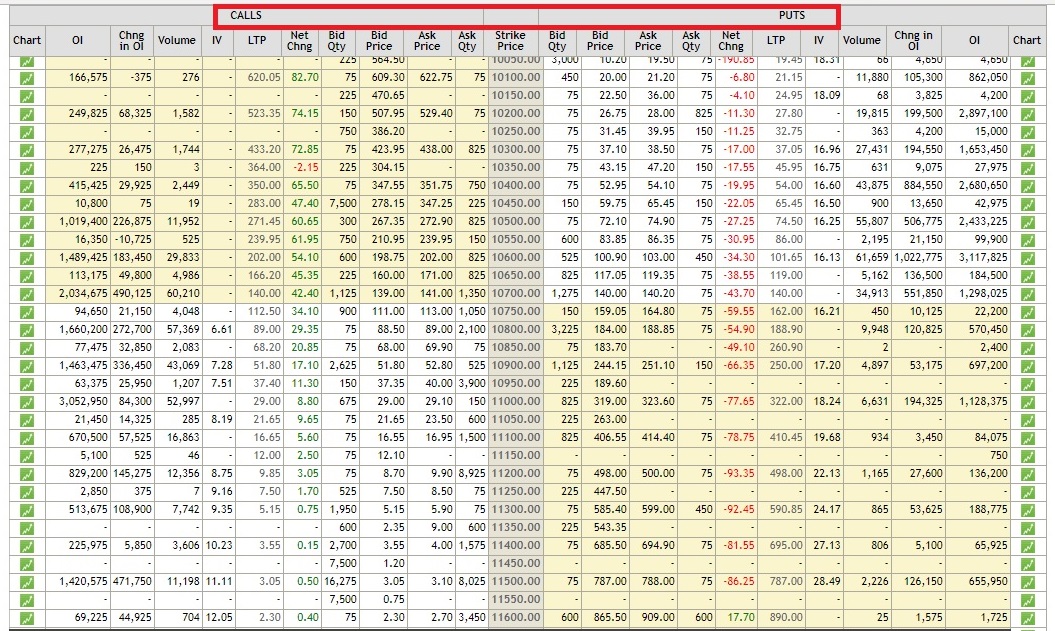

Understanding an Option Chain. The option chain not only captures the price and volume data but also more analytical parameters like the shifts in open interest OI shifts in implied volatility IV etc. Typically to manage risk the number of short options is lower than the number of long options ie.

Volume and Open Interest. The break-even point will be the options strike price A minus the premium received for the option. LossThe maximum loss is the strike price A less the premium received.

The Option Chain. The strike price divides all the information for calls and puts. The Option Chain.

At the end of this article you will understand the following pointers in detail which are related to Option Chain Analysis. Key components of the option chain frame. Learning how to read an option chain is a vital part to options trading.

Many traders lose money in options trading because they dont fully understand option chains. Once you understand the option chain your option trading stratergy and money making skills in. Lets understand each component in detail now.

All the information to the left of the strike price will be for calls and all the information to the right is for. Call and PutA Call Option is a contract that gives you the right but not the obligation to buy the underlying at a specified price and within the expiration date of the Option. Knowing how to read an options chain makes up the core of trading options.

The number is updated daily based on the previous. Learning to read an options table will provide more insight into. What is open interest.

Terms can be found in the option chain or check with the Options Clearing Corp to find out the new terms of an adjusted option. In this chapter we shall study about how to read an option chain using two vital tools. It is not static.

So lets say you get. Thats if youre a buyer of puts. In general a put allows you to put that stock to someone else.

These are various components of an Options Chart. Option chain data can be used to find out the actual trend of market. Before understanding how to read the option chain data in NSE let us first look at the key components of the option chain.

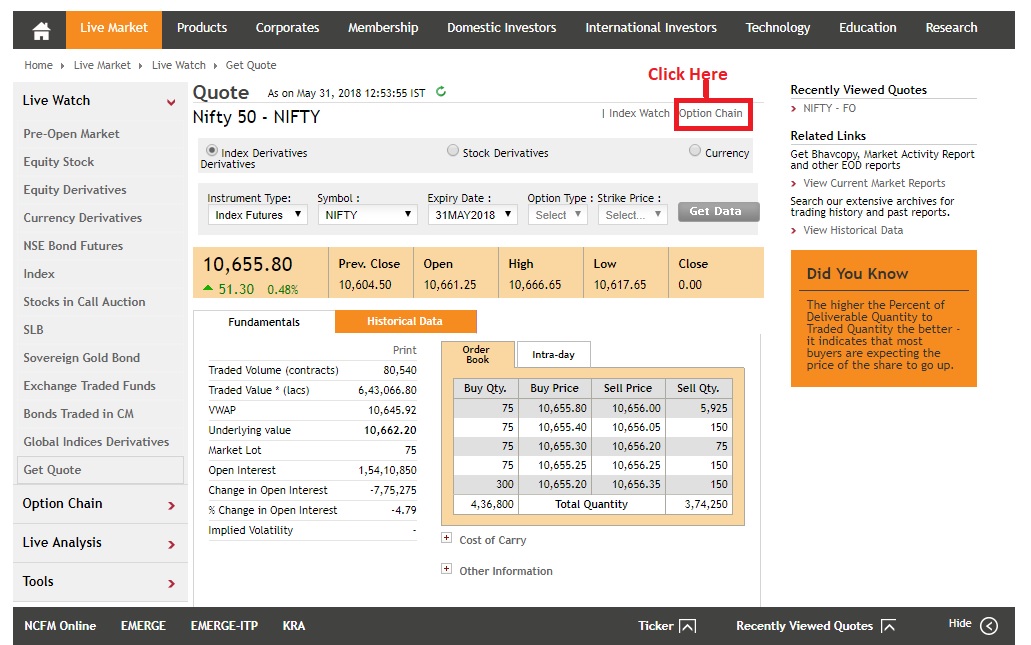

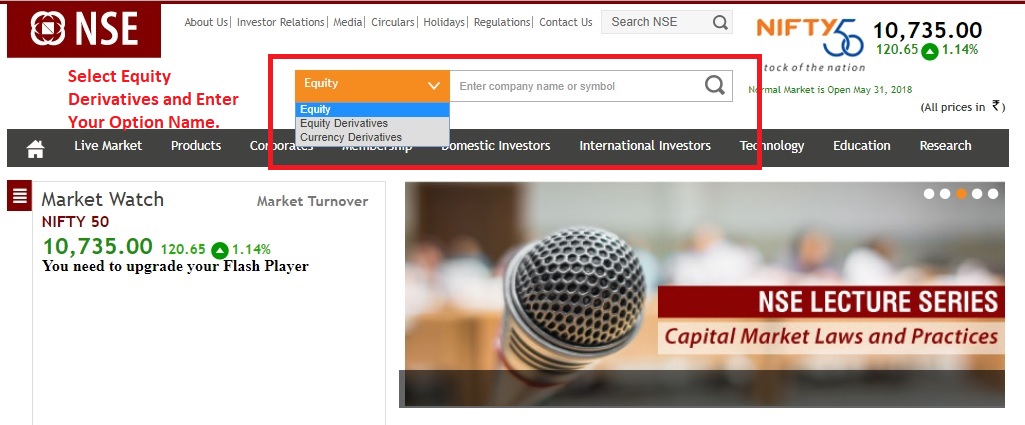

We will use the option chain available on the website of the National Stock Exchange as our reference. Supporting documentation for any claims if applicable will be. Before trading options please read Characteristics and Risks of Standardized Options and call 800-544- 5115 to be approved for options trading.

There are only 2 types of stock option contracts Puts and Calls so an option chain is essentially a list of all the Puts and Calls available for the particular stock youre looking at. Highlighted above are the strike prices notice how they are in the middle of the options chainThats because there are both calls left side and puts right side for each strike price at each expiration date. Optionchain openinterest optionsguideInvest and trade with Kite by Zerodha Get assured Services free from us.

Where can you find options quotes and information. Image above is from a customized Option Chain in Active Trader Pro. Many traders lose money because they dont fully understand option chains.

The option value will increase as volatility increases bad. Options Reading Option Chain using Volume OI. In this article I am going to discuss the Option Chain Analysis in TradingPlease read our previous article where we discussed Opening Range Breakout with examples.

Option pricing models also give us Greeks- values used to determine how the underlying asset and option price are related. If youre a buyer of calls it allows you to get that stock at a lower price. A multi-leg options trade of either all calls or all puts whereby the number of long options to short options is something other than 11.

Option Chain Analysis in Trading. The maximum profit is the premium you sold the option for. What is Open Interest.

Learning how to read an option chain is a vital component to options trading. So lets say the stock tanks you could put it to someone else. Or buy the option back to close.

Oliver Velez Reading The Bars Velez Reading Oliver

Option Chain Analysis With Examples Dot Net Tutorials

Option Chain Tutorial How To Read An Options Table Options Trading Strategies Option Strategies Reading

Iron Condors The Best Option Strategies Volume 2 Pdf Option Strategies Iron Condor Strategies

Option Chain Analysis With Examples Dot Net Tutorials

How To Read Options Chain Explained With Example

Option Trading Basics How To Read A Stock Option Quote Ally Whiteboard Video Series Youtube

How To Read Options Chain Explained With Example

Option Chain Analysis With Examples Dot Net Tutorials

How To Read Options Chain Explained With Example

How To Read Options Chain Explained With Example

Option Chain Analysis With Examples Dot Net Tutorials

How To Read Options Chain Explained With Example

Option Chain Analysis With Examples Dot Net Tutorials

8 Wins And Zero Loss Best Signal Indicators 99 Work In Iq Option Trading Youtube Option Trading Intraday Trading Options Trading Strategies

How To Analyze Call And Put Writing And Predict Trends Bullbull

How To Analyze Call And Put Writing And Predict Trends Bullbull

How To Read An Options Chain The Ultimate Guide Reading Options Option Trading

Post a Comment for "How To Read Option Chain Pdf"